Small business owners often ask, “Which is the best accounting software?” The answer depends on your needs.

The right software can simplify tasks and save time. Accounting software helps manage finances, track expenses, and generate reports. With many options available, it’s hard to choose. This blog will explore various software choices. We will look at features, ease of use, and pricing.

Our goal is to help you find the best fit for your small business. By the end, you will have a clearer idea of which accounting software suits you. So, let’s dive in and discover the top options available for small business owners today.

Introduction To Small Business Accounting Software

Choosing the right accounting software is vital for small businesses. It can streamline financial tasks and help maintain accuracy. With a variety of options available, selecting the best one can be overwhelming. This guide introduces you to small business accounting software, its importance, and key features.

Importance Of Accounting Software

Accounting software simplifies managing finances. It helps track income, expenses, and profits. It reduces the chance of human error. Small business owners can save time and focus on growing their business. It also helps in making informed financial decisions. Easy access to financial data ensures compliance with tax regulations.

Key Features To Look For

Look for user-friendly interfaces. The software should be easy to navigate. It should offer features like invoicing, expense tracking, and financial reporting. Integration with other tools like payroll and inventory is beneficial. Cloud-based options allow access from anywhere. Security features are crucial to protect sensitive financial data.

Credit: howtostartanllc.com

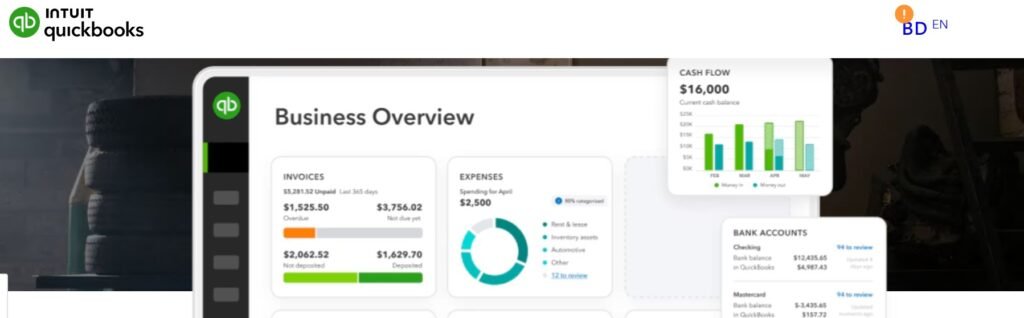

Quickbooks Online

QuickBooks Online is a popular choice for small business accounting. It offers a range of features and tools to help manage finances. With its cloud-based platform, users can access their data anytime, anywhere.

Overview

QuickBooks Online provides an easy-to-use interface. It helps with invoicing, expense tracking, and financial reporting. The software integrates with many bank accounts and other apps. It is designed to simplify financial tasks for small businesses.

Pros And Cons

Pros:

- User-friendly interface

- Accessible from any device with an internet connection

- Integration with many financial apps

- Comprehensive support and tutorials

Cons:

- Monthly subscription fees

- Limited features in the basic plan

- Can be overwhelming for beginners

Pricing

QuickBooks Online offers different pricing plans. The Simple Start plan costs $25 per month. The Essentials plan costs $50 per month. The Plus plan is $80 per month. Each plan offers more features and support.

Xero

Xero is a popular cloud-based accounting software designed for small businesses. It offers a range of features that can help manage your finances efficiently. Whether you are just starting out or have been in business for a while, Xero provides tools that are easy to use and understand.

Overview

Xero offers a comprehensive set of accounting tools. These include invoicing, payroll, and expense tracking. The software is accessible from any device with an internet connection, making it convenient for business owners on the go. Xero is known for its user-friendly interface and robust customer support.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Pricing

Xero offers several pricing plans to fit different needs. Here are the current options:

- Early: $11/month – Ideal for new businesses.

- Growing: $32/month – Best for expanding businesses.

- Established: $62/month – Perfect for well-established businesses.

Each plan includes a 30-day free trial. This allows you to test the features before committing.

Credit: www.pcmag.com

Freshbooks

FreshBooks is a popular choice for small businesses. It offers a simple and intuitive interface. This cloud-based accounting software helps you manage invoices, expenses, and time tracking. FreshBooks is known for its ease of use and excellent customer support.

Overview

FreshBooks is designed with small business owners in mind. It offers features like invoicing, expense tracking, and project management. FreshBooks also integrates with many other apps. This makes it a versatile tool for many types of businesses. The mobile app allows you to manage your finances on the go.

Pros And Cons

Pros:

- User-friendly interface

- Excellent customer support

- Comprehensive invoicing features

- Mobile app availability

- Integrates with various apps

Cons:

- Limited features in the basic plan

- Can be expensive for larger teams

- Some features may require additional fees

Pricing

FreshBooks offers several pricing plans. The Lite plan starts at $15 per month. The Plus plan costs $25 per month. The Premium plan is $50 per month. Custom pricing is available for larger businesses. FreshBooks also offers a 30-day free trial.

Zoho Books

Zoho Books is a popular accounting software designed for small businesses. It helps manage finances, track expenses, and generate reports. It offers a user-friendly interface and integrates with other Zoho apps.

Overview

Zoho Books provides comprehensive accounting solutions. It includes invoicing, expense tracking, and project management. The software is cloud-based and accessible from any device. Zoho Books supports multiple currencies and automates workflows to save time.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Pricing

Zoho Books offers several pricing plans. The plans cater to different business needs. Here are the current pricing plans:

- Free Plan: For businesses with revenue below $50K per year.

- Standard Plan: $15 per month. Includes basic features.

- Professional Plan: $40 per month. Adds advanced features.

- Premium Plan: $60 per month. Suitable for growing businesses.

Zoho Books also offers a 14-day free trial. It allows users to explore features before committing.

Wave Accounting

Wave Accounting is a popular option for small business owners. It offers a range of tools to help manage your finances. Designed with simplicity in mind, Wave is user-friendly and powerful. Let’s dive into the details of Wave Accounting.

Overview

Wave Accounting is a free accounting software. It covers invoicing, accounting, and receipts. Small business owners can track income, expenses, and connect their bank accounts. Wave also has tools for payroll and payments.

Pros And Cons

Wave offers many benefits for small businesses. Here are some pros:

- Free to use with no hidden fees

- User-friendly interface

- Integration with bank accounts

- Invoicing and receipt scanning

Despite its advantages, Wave has some downsides:

- Limited customer support

- Not suitable for larger businesses

- Advanced features require payment

Pricing

Wave Accounting is free for most features. Users can access accounting, invoicing, and receipt scanning without charges. For payroll, the cost starts at $20 per month. Payment processing fees are 2.9% plus 30¢ per transaction. These fees are standard in the industry.

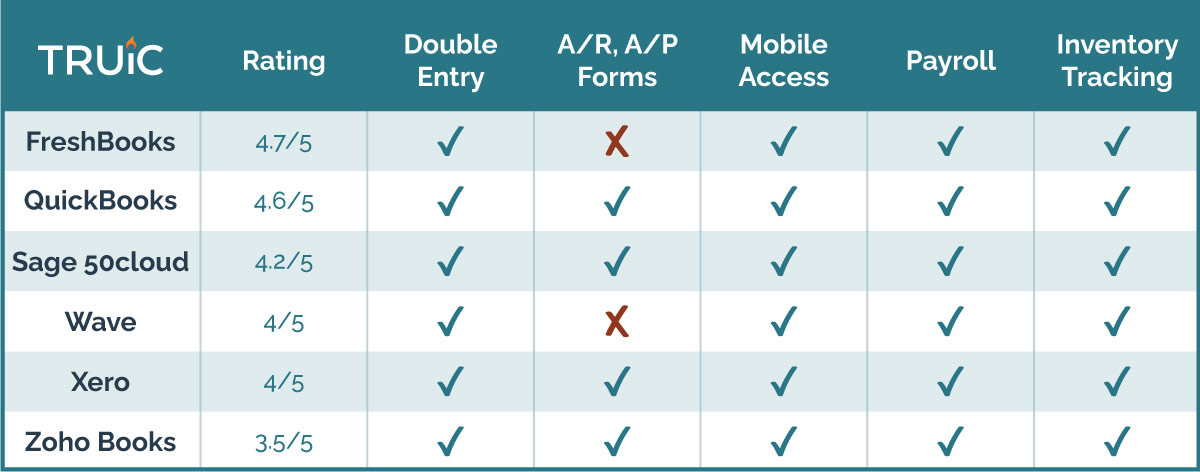

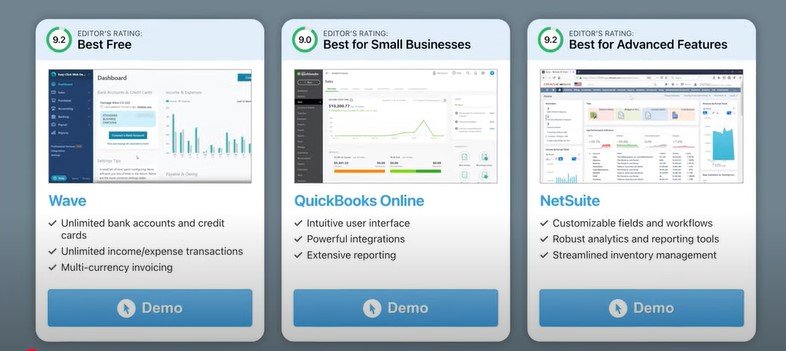

Comparing Top Accounting Software

Choosing the right accounting software for your small business can be challenging. There are many options available, each with different features, pricing, and user experience. This section will compare the top accounting software to help you make an informed decision.

Features Comparison

Let’s look at the features offered by the leading accounting software. QuickBooks offers invoicing, expense tracking, and payroll management. FreshBooks provides time tracking, project management, and reporting tools. Xero includes bank reconciliation, inventory tracking, and multi-currency support. Each software has unique strengths, so choose based on your business needs.

Pricing Comparison

Pricing is a crucial factor for small businesses. QuickBooks offers different plans starting from $25 per month. FreshBooks pricing starts at $15 per month, with various tiers. Xero’s plans begin at $11 per month. Consider the features you need and your budget to select the best plan.

User Experience

User experience can affect how efficiently you manage your finances. QuickBooks has an intuitive interface that is easy to navigate. FreshBooks is user-friendly with a clean design. Xero provides a streamlined experience with a simple layout. Try demos or free trials to see which software feels right for you.

Choosing The Right Software

Finding the best accounting software for your small business can be tricky. There are many options available, each with its own set of features. The right choice depends on your specific needs and circumstances. Here, we’ll guide you through the main considerations to help you make an informed decision.

Assessing Business Needs

Start by understanding your business requirements. Do you need basic bookkeeping or advanced financial management? Identify the tasks you need help with. This can include invoicing, payroll, or inventory management. Make a list of features that are essential for your business.

Budget Considerations

Set a budget for your accounting software. Prices can vary greatly. Some programs offer free basic plans, while others have monthly or yearly subscriptions. Determine what you can afford. Remember, the cheapest option may not always be the best. Balance cost with the features you need.

User Reviews

User reviews can provide valuable insights. Check what other small business owners say. Look for reviews on trusted websites. Pay attention to comments about ease of use, customer support, and reliability. Positive reviews from similar businesses can be a good sign.

Credit: bbcincorp.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software for small businesses varies by needs. Popular options include QuickBooks, FreshBooks, and Xero. Each offers unique features.

Is Quickbooks Good For Small Businesses?

Yes, QuickBooks is highly rated for small businesses. It offers robust features for invoicing, expense tracking, and payroll.

How Does Freshbooks Help Small Businesses?

FreshBooks is excellent for invoicing, time tracking, and expense management. It’s user-friendly and ideal for service-based businesses.

Is Xero Suitable For Small Business Accounting?

Yes, Xero is suitable for small business accounting. It offers cloud-based solutions, easy integration, and comprehensive financial reporting.

Conclusion

Choosing the best accounting software depends on your specific business needs. Evaluate features, pricing, and ease of use. QuickBooks, Xero, and FreshBooks are popular choices. They offer robust features for small businesses. Compare and test different options. Consider your budget and required functionalities.

Reliable accounting software can simplify your financial tasks. It helps maintain accuracy and efficiency. Make an informed decision. Your business will benefit in the long run.