Invoicing can be a daunting task for many businesses. It involves multiple steps and meticulous attention to detail.

An invoicing checklist is essential for ensuring accuracy and efficiency. Whether you are a freelancer, small business owner, or developer, having a structured approach to invoicing can save time and prevent errors. This blog post will guide you through the crucial elements of an invoicing checklist, making the process smoother and more manageable. By following this checklist, you can ensure that your invoices are clear, professional, and prompt, leading to faster payments and better client relationships. For an all-in-one invoicing solution, consider using Invoiless. It simplifies the entire process, from creating to tracking invoices. Learn more about Invoiless here.

Clear invoices, smooth cash flow—precision pays off.

Introduction To Invoicing Checklist

Creating and managing invoices can be a time-consuming task for businesses. An invoicing checklist helps streamline this process, ensuring accuracy and timeliness. This guide will explore the importance of accurate invoicing and its impact on business health.

Importance Of Accurate Invoicing

Accurate invoicing is crucial for maintaining a healthy cash flow. Errors can lead to delays in payments and strained client relationships. With Invoiless, you can create, send, and track invoices effortlessly, reducing the chances of mistakes.

- Prevent Payment Delays: Correct invoices ensure clients pay on time.

- Enhance Professionalism: Accurate invoices reflect your business’s reliability and professionalism.

- Minimize Disputes: Clear and precise invoices reduce the likelihood of disputes.

Using a platform like Invoiless, which offers features like an easy-to-use invoice builder and secure online payments, helps maintain accuracy and efficiency.

Impact Of Timely Payments On Business Health

Timely payments are vital for the financial health of any business. They ensure you have the necessary funds to manage operations and invest in growth. With Invoiless, you can track payments and manage your cash flow efficiently.

- Improved Cash Flow: Timely payments mean you have cash on hand to meet expenses.

- Reduced Stress: Knowing payments are coming in on time can reduce financial stress.

- Business Growth: With a steady cash flow, you can invest in new opportunities.

Invoiless integrates with payment gateways like Stripe, GoCardless, and PayPal, ensuring secure and prompt payments. This helps in maintaining a healthy business environment.

| Feature | Benefit |

|---|---|

| Easy-to-use invoice builder | Streamlines the invoicing process |

| Accept online payments | Faster payment collection |

| Track payments | Better cash flow management |

By incorporating an invoicing checklist and using a robust platform like Invoiless, businesses can ensure accuracy and timeliness in their invoicing process. This, in turn, promotes a healthy financial environment and fosters growth.

Key Components Of An Effective Invoicing Checklist

An effective invoicing checklist ensures smooth financial transactions and timely payments. It helps businesses avoid common invoicing mistakes and adhere to legal requirements. Below are the key components to include in your invoicing checklist to streamline your invoicing process.

Essential Information To Include

Every invoice must contain basic details to make it clear and professional. Here is a list of the essential information:

- Invoice Number: Unique identifier for each invoice.

- Invoice Date: Date the invoice is issued.

- Due Date: Date by which payment should be made.

- Seller’s Information: Business name, address, and contact details.

- Buyer’s Information: Customer’s name, address, and contact details.

- Description of Services or Products: Detailed list of items or services provided.

- Quantity and Price: Number of items and price per unit.

- Total Amount Due: Sum of all charges, including taxes and discounts.

- Payment Terms: Conditions for payment, such as methods accepted and late fees.

Legal Requirements And Compliance

Invoices must meet specific legal requirements to be valid. Make sure your invoices comply with the following:

- Tax Information: Include applicable tax details like VAT, GST, or sales tax.

- Company Registration Numbers: Business registration or tax identification numbers.

- Compliance with Local Laws: Ensure invoices adhere to local and international laws.

- Electronic Signature: If required, include an electronic signature for authenticity.

Standardizing Invoice Formats

Having a standardized invoice format helps maintain consistency and professionalism. Consider these points:

- Template Design: Use a consistent template with your company’s branding.

- Clear Layout: Ensure the layout is easy to read and understand.

- Custom Fields: Add custom fields to capture additional information if needed.

- Automated Invoicing: Use software like Invoiless to automate and manage your invoices.

A strong invoicing system is the backbone of a healthy business. Get invoicing software

Steps To Ensure Accuracy In Invoicing

Ensuring accuracy in invoicing is critical for businesses, especially for small to medium enterprises. Accurate invoices help maintain a healthy cash flow and build trust with clients. Here are key steps to ensure your invoicing is precise and error-free.

Double-checking Client Information

Always double-check the client information before sending an invoice. This includes the client’s name, address, and contact details. Incorrect details can delay payments and harm your professional reputation.

| Client Detail | Action |

|---|---|

| Name | Verify spelling and legal name |

| Address | Confirm mailing and billing addresses |

| Contact Information | Ensure phone numbers and emails are correct |

Itemizing Products Or Services

Itemize all products or services provided. This helps the client understand what they are being billed for and reduces disputes. Each item should have a clear description, quantity, unit price, and total cost.

- Clear Descriptions: Provide a brief but clear description of each item.

- Quantity: Specify the amount or number of units.

- Unit Price: State the price per unit or service.

- Total Cost: Calculate the total cost for each item.

Verifying Payment Terms And Conditions

Clearly state the payment terms and conditions. This includes due dates, payment methods, and any late fees. Clear terms help avoid misunderstandings and late payments.

- Due Dates: Specify the invoice due date.

- Payment Methods: Mention accepted payment methods like Stripe, GoCardless, and PayPal.

- Late Fees: Include details about any penalties for late payments.

Using Invoiless, an all-in-one invoicing solution, can simplify these steps. Invoiless allows you to create, send, manage, and track invoices with ease. With features like easy-to-use invoice builder and secure online payments, it ensures your invoicing process is efficient and accurate.

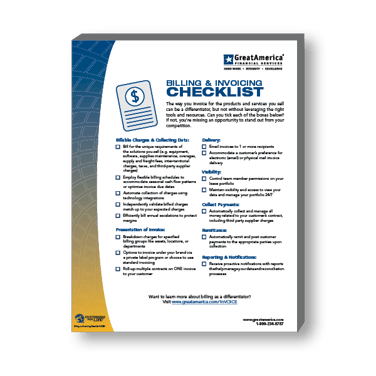

Credit: www.greatamerica.com

Tools And Software For Streamlining Invoicing

Efficient invoicing is crucial for maintaining a healthy cash flow. Using the right tools and software can significantly simplify this process. With automated systems, businesses can save time and reduce errors. Here are some popular options and their benefits.

Popular Invoicing Software Options

There are numerous invoicing software options available. Here are some of the most popular ones:

- Invoiless: An all-in-one platform for small to medium businesses and freelancers. It offers an easy-to-use invoice builder, online payment acceptance, and integration with various platforms like Google Drive, PayPal, and Slack.

- FreshBooks: Known for its user-friendly interface and comprehensive features. It supports expense tracking, time tracking, and offers various integrations.

- QuickBooks: A robust accounting software that also provides invoicing capabilities. It is suitable for businesses of all sizes and integrates well with other financial tools.

- Zoho Invoice: A free invoicing solution for small businesses. It offers customizable templates, automated reminders, and detailed reporting.

Benefits Of Automation In Invoicing

Automating the invoicing process offers several advantages:

- Time-saving: Automation reduces the time spent on manual invoice creation and management.

- Accuracy: Minimizes human errors, ensuring accurate invoicing and payment tracking.

- Faster payments: Automated reminders and online payment options lead to quicker payment collections.

- Improved cash flow: Timely invoicing and payments help maintain a steady cash flow.

- Better customer experience: Professional and timely invoices enhance client satisfaction.

Integrating Invoicing Tools With Accounting Systems

Integrating invoicing tools with accounting systems can streamline financial management:

| Invoicing Tool | Accounting System | Integration Benefits |

|---|---|---|

| Invoiless | QuickBooks, Xero | Synchronize invoices and payments, reduce data entry, generate comprehensive financial reports |

| FreshBooks | Gusto, Stripe | Seamless payroll and payment processing, unified financial data |

| Zoho Invoice | Zoho Books | Complete financial management within the Zoho ecosystem |

By leveraging these tools and integrations, businesses can enhance efficiency, accuracy, and financial oversight, leading to better overall performance.

Best Practices For Timely Payments

Ensuring timely payments is crucial for maintaining a healthy cash flow. By implementing effective invoicing strategies, businesses can minimize delays and improve their financial stability. Here are some best practices to help secure timely payments:

Setting Clear Payment Deadlines

Establishing clear payment deadlines is essential for prompt payments. Always specify the due date on your invoices. Use phrases like “Payment Due By” followed by the exact date. This creates a sense of urgency and clarity.

Consider using the following formats for clarity:

- Net 30: Payment due within 30 days

- Net 15: Payment due within 15 days

- Due on Receipt: Immediate payment required

Ensure these deadlines are consistent across all client communications. This sets the right expectations from the start.

Implementing Early Payment Incentives

Encouraging clients to pay early can significantly reduce payment delays. Offer discounts for early payments to motivate clients. For example:

- 2% discount if paid within 10 days

- 5% discount for payments made within 5 days

These incentives can make a big difference. Clients are more likely to prioritize your invoice.

Effective Communication With Clients

Maintaining open lines of communication is key to timely payments. Regularly update clients on their payment status. Use friendly reminders before and after the due date.

Consider these communication steps:

- Send a reminder email a week before the due date.

- Follow up with a phone call if payment is late.

- Send a final notice if payment remains overdue.

Utilize tools like Invoiless to automate these reminders. This saves time and ensures consistency.

Remember, polite and professional communication fosters positive client relationships and improves payment timeliness.

Common Invoicing Mistakes To Avoid

Creating and managing invoices can be a tedious task. Avoiding common mistakes can help ensure smooth transactions and timely payments. Here are some typical invoicing mistakes to watch out for:

Overlooking Minor Details

Small errors can cause big problems. Ensure every invoice includes:

- Correct contact information: Double-check the recipient’s name, address, and email.

- Accurate item descriptions: Clearly describe each product or service.

- Exact amounts: Verify the quantities and prices to avoid discrepancies.

Missing these details can lead to delays and confusion. Using a platform like Invoiless can help automate these checks.

Inconsistent Invoice Numbering

Inconsistent numbering can make tracking and managing invoices difficult. Ensure your invoices have:

- Sequential numbers: Keep a logical sequence to avoid confusion.

- Unique identifiers: Each invoice should have a unique number to prevent duplication.

Using a system like Invoiless helps maintain consistency and organization.

Failing To Follow Up On Overdue Payments

Unpaid invoices can affect cash flow. Follow up on overdue payments by:

- Setting reminders: Use automated reminders for timely follow-ups.

- Communicating clearly: Send polite but firm reminders to clients.

- Offering multiple payment options: Make it easy for clients to pay using platforms like Stripe, GoCardless, or PayPal.

An efficient invoicing tool like Invoiless can automate follow-ups and help manage overdue payments.

Pros And Cons Of Manual Vs. Automated Invoicing

Managing invoices can be a daunting task for businesses. Choosing between manual and automated invoicing is crucial. Each method has its own set of advantages and disadvantages. Here, we will explore these aspects in detail.

Advantages Of Manual Invoicing

Manual invoicing offers a personal touch and flexibility. It allows for more control over the invoicing process. Some key advantages include:

- Customization: Tailor invoices to client needs.

- Flexibility: Adjust invoices easily.

- No reliance on technology: No need for software or internet.

Challenges Of Manual Processes

Despite its benefits, manual invoicing comes with several challenges:

- Time-consuming: Creating and sending invoices takes time.

- Prone to errors: Human errors can lead to mistakes.

- Difficulty in tracking: Harder to manage and track invoices.

Benefits Of Automated Invoicing

Automated invoicing streamlines the process and saves time. Invoiless, for example, offers various benefits:

- Efficiency: Create, send, and track invoices quickly.

- Accuracy: Reduces errors with automation.

- Integration: Connects with platforms like Stripe and PayPal.

- Management: Manage payments and track income/expenses in one place.

- Reports: Generate detailed reports easily.

Potential Drawbacks Of Automation

Automated invoicing is not without its drawbacks:

- Initial setup: Takes time to set up the system.

- Cost: Software may require an upfront investment.

- Technical issues: Dependency on technology can lead to downtime.

Overall, Invoiless offers a comprehensive solution to streamline invoicing. It combines the benefits of automation with a user-friendly interface, ensuring efficient and accurate invoicing for businesses.

Credit: tauruscollections.com

Recommendations For Different Business Scenarios

Finding the right invoicing solution is crucial for any business. Different businesses have unique needs. Here’s a tailored approach for various scenarios.

Invoicing For Small Businesses

Small businesses often have limited resources and need efficient invoicing tools. Invoiless offers an easy-to-use invoice builder. This tool helps create, send, and track invoices. Small businesses can also manage payments in one place using integrations with Stripe, GoCardless, and PayPal.

- Create and send invoices quickly

- Track payments and manage them securely

- Generate detailed financial reports

- Use the customer portal for better client interactions

Invoicing For Freelancers

Freelancers need a streamlined invoicing process to save time. Invoiless provides features that cater specifically to freelancers. The platform allows for unlimited recurring invoices, which is ideal for ongoing projects.

- Easy-to-use interface for quick invoice creation

- Automated recurring invoices for ongoing work

- Track income and expenses efficiently

- Access to a customer portal with registration options

Invoicing For Large Enterprises

Large enterprises require more advanced invoicing solutions. Invoiless offers comprehensive management features. Enterprises can benefit from API access for custom integrations and unlimited team member support.

- Manage multiple invoices and clients effortlessly

- Integrate with existing systems using API

- Track products with inventory management

- Generate detailed and customized reports

Invoiless provides an all-in-one solution to meet the invoicing needs of small businesses, freelancers, and large enterprises. With its comprehensive features, managing invoices has never been easier.

Credit: www.linkedin.com

Frequently Asked Questions

What Is An Invoicing Checklist?

An invoicing checklist is a tool that helps ensure all necessary information is included in invoices. It ensures accuracy and consistency.

Why Is An Invoicing Checklist Important?

An invoicing checklist reduces errors, improves efficiency, and ensures timely payments. It helps maintain professional and accurate records.

What Should Be Included In An Invoice?

An invoice should include contact details, itemized list of services, total amount, payment terms, and due date.

How Can An Invoicing Checklist Help Businesses?

An invoicing checklist helps businesses maintain accuracy, avoid disputes, and streamline the invoicing process. It ensures completeness.

Conclusion

Wrapping up your invoicing tasks can be easy with the right tools. Invoiless offers a seamless solution for creating, managing, and tracking invoices. This all-in-one platform saves time and improves payment collection. Simplify your invoicing process today. Try Invoiless now and see the difference.